The Role of Offshore Finance Centres in Global Tax Obligation Planning

The Role of Offshore Finance Centres in Global Tax Obligation Planning

Blog Article

The Impact of Offshore Money Centres on International Organization Workflow and Conformity

Offshore Financing Centres (OFCs) have come to be crucial in shaping global company operations, using one-of-a-kind advantages such as tax obligation optimization and regulatory versatility. The boosting worldwide emphasis on conformity and transparency has presented a complicated range of challenges for companies seeking to utilize these centres.

Understanding Offshore Money Centres

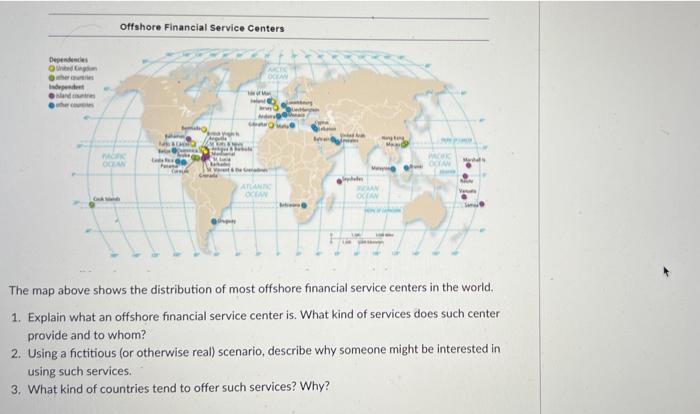

Offshore financing centres (OFCs) offer as crucial hubs in the global financial landscape, facilitating international business deals and financial investment possibilities. These jurisdictions, frequently identified by beneficial regulatory settings, tax rewards, and privacy regulations, attract a varied range of economic services, including financial investment, insurance policy, and financial monitoring. OFCs make it possible for services to enhance their economic procedures, take care of threat much more successfully, and accomplish better flexibility in their monetary techniques.

Commonly located in areas with reduced or no tax, such as the Caribbean, the Network Islands, and certain Eastern regions, OFCs offer a lawful structure that enables business to run with relative convenience. They frequently have robust economic infrastructures and a solid focus on confidentiality, which appeals to high-net-worth people and multinational corporations seeking to safeguard their possessions and access to global markets.

The operational structures of OFCs can vary significantly, influenced by neighborhood guidelines and global conformity criteria. Comprehending the unique attributes of these centres is essential for companies seeking to browse the complexities of worldwide finance (offshore finance centres). As the worldwide financial landscape evolves, OFCs remain to play a significant role in shaping the methods of companies running throughout borders

Benefits of Making Use Of OFCs

Using offshore money centres (OFCs) can dramatically enhance a firm's economic performance, specifically when it comes to tax optimization and regulative versatility. Among the key advantages of OFCs is their ability to provide favorable tax obligation programs, which can result in considerable financial savings on business taxes, capital gains, and inheritance taxes. By purposefully allocating earnings to jurisdictions with lower tax obligation rates, firms can enhance their total economic performance.

Moreover, OFCs usually existing streamlined regulative settings. This reduced governmental concern can promote quicker decision-making and more dexterous company operations, permitting firms to respond swiftly to market modifications. The governing frameworks in lots of OFCs are made to attract foreign investment, providing businesses with a helpful setting for growth and expansion.

Additionally, OFCs can offer as a critical base for worldwide procedures, allowing companies to access global markets a lot more effectively. Improved confidentiality actions additionally protect delicate financial details, which can be crucial for preserving competitive benefits. Overall, making use of OFCs can develop an extra reliable monetary framework, supporting both operational effectiveness and critical company goals in an international context.

Challenges in Compliance

Another significant challenge is the developing nature of worldwide policies focused on combating tax obligation evasion and cash laundering. As federal governments tighten examination and boost reporting requirements, companies should remain dexterous and informed to stay clear of charges. This requires ongoing investment in conformity sources and training, which can stress functional budget plans, specifically for smaller sized enterprises.

Additionally, the perception of OFCs can create reputational threats. Business operating in these territories may face suspicion regarding their objectives, leading to prospective complications in stakeholder relations. This can detrimentally affect consumer trust and investor confidence, more complicating compliance initiatives. Eventually, businesses have to thoroughly browse these challenges to make sure both conformity and sustainability in their international operations.

Regulatory Trends Influencing OFCs

Recent governing patterns are considerably improving the landscape of overseas money centres (OFCs), engaging businesses to adjust to a progressively rigorous compliance setting. Governments and worldwide organizations are carrying this post out durable procedures to boost openness and fight tax obligation evasion. This shift has actually caused the fostering of campaigns such as the Usual Coverage Criterion (CRS) and the Foreign Account Tax Obligation Conformity Act (FATCA), which call for OFCs to report economic details concerning foreign account holders to their home territories.

:max_bytes(150000):strip_icc()/offshore.asp-FINAL-1-941110e2e9984a8d966656fc521cdd61.png)

As compliance prices rise and regulative examination intensifies, businesses making use of OFCs should navigate these modifications meticulously. Failing to adjust can cause severe charges and reputational damages, emphasizing the relevance of positive conformity strategies in the advancing landscape of overseas financing.

Future of Offshore Finance Centres

The future of overseas finance centres (OFCs) is positioned for significant change as progressing governing landscapes and moving international financial dynamics improve their function in global organization. Boosting stress for openness and conformity will test conventional OFC versions, prompting a change in the direction of better accountability and adherence to worldwide standards.

The fostering of electronic modern technologies, including blockchain and expert system, is expected to redefine how OFCs run. These developments might improve operational performance and improve compliance mechanisms, enabling OFCs to provide even more safe and secure and clear solutions. In addition, as global capitalists look for territories that prioritize sustainability and corporate social obligation, OFCs will require to adjust by accepting sustainable finance concepts.

In reaction to these fads, some OFCs are diversifying their service offerings, moving beyond tax optimization to include riches administration, fintech remedies, and advisory solutions that straighten with global ideal techniques. As OFCs progress, they should stabilize the requirement for competitive advantages with the need learn this here now to satisfy tightening laws. This double focus will eventually determine their sustainability and importance in the worldwide service landscape, guaranteeing they remain indispensable to global monetary operations while also being responsible company people.

Verdict

The influence of Offshore Finance Centres on global company procedures is extensive, offering many advantages such as tax efficiencies and streamlined processes. As international criteria progress, the functional landscape for organizations utilizing OFCs is transforming, requiring a strategic approach to guarantee adherence.

Offshore Financing Centres (OFCs) have become more critical in shaping global organization procedures, providing one-of-a-kind benefits such as tax obligation optimization and regulatory flexibility.Offshore finance centres (OFCs) offer as essential hubs in the international economic landscape, promoting worldwide organization transactions and investment possibilities. Overall, the use of OFCs can develop a much more effective financial framework, supporting both functional efficiency and tactical company purposes in a worldwide context.

Navigating the intricacies of compliance in overseas finance centres (OFCs) offers substantial difficulties for companies.Current regulatory patterns are dramatically reshaping the landscape of overseas financing centres (OFCs), compelling companies to adjust to an increasingly stringent conformity setting.

Report this page